The payslip provides a detailed breakdown of the salary you have received for a given month. Below, you will find an example of an ordinary payslip, along with explanations for some of the fields. Additionally, you will find an explanaton for holiday pay and tax deductions for payslips in June.

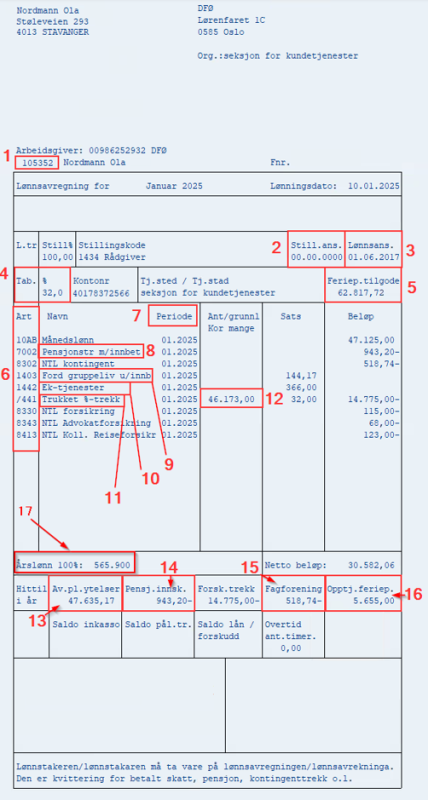

Ordinary payslip

- Employee number

- Seniority date for position. Employees holding positions that fall under a ladder-type pay scale ("lønnsstige"), are given annual seniority raises based on this date, and in accordance with the Collective Agreements. For other employees (such as in this case), this date will often show as "00.00.0000".

- Other seniority date(s) that may not directly affect salary

- Ttype of tax deduction: table or percentage

- Holiday pay for payment in June

- Number codes for wage types. Wage types instruct the payroll system how each of the lines are to be treated.

- The period the payment or deduction is related to

- Deduction for occupational pension scheme

- Benefit taxation of group life insurance for state employees

- Benefit taxation of mobile/broadband paid directly by employer

- Tax deduction

- Basis for tax calculation for the period the payslip is for

- Basis for tax calculation for the year to date

- Your share of contributions to the occupational pension scheme for the year to date

- Trade union fees deducted for the year to date

- Earned holiday pay for the year to date, for payment next year. The holiday pay next year may be lower than this amount for those over 60 years of age, due to reduction rules in the Act relating to Holidays for the 6th holiday week.

- Gross annual salary (before decution for training and development funds, regulated in the agreement between the state and trade unions).

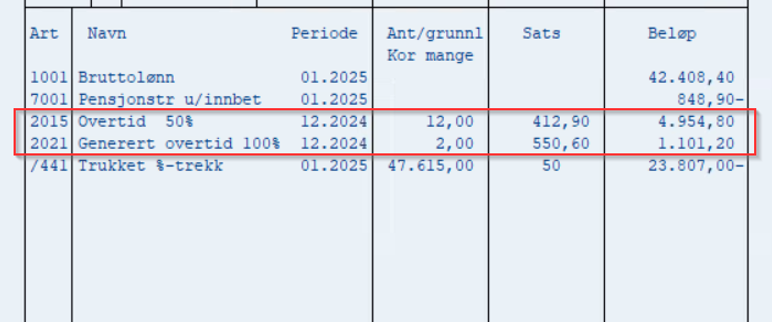

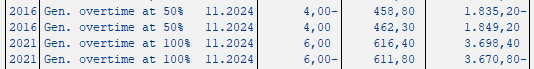

Overtime on payslip

The type of overtime paid, for example 50% overtime or 100% overtime, is indicated in the name ("Navn"). Overtime is usually paid in arrears.

The time period for the overtime is indicated in the column for period ("Periode"). The column " No./basis " ("Ant/grunnlag Kor mange") will indicate the number of overtime hours that are approved, and payable for the period on thepayslip in question.

In some cases, you may receice overtime payments from previous months, for example if you have received a post for correction and must submit this again for approval. This will then be paid in arrears on a later payroll run.

The number of hours for overtime is rounded off in accordance with the comments in §13 of the Collective agreements. Minutes are rounded off to whole or half hours by increasing 30 minutes or more to the nearest whole hour separately, while 29 minutes or less are lost.

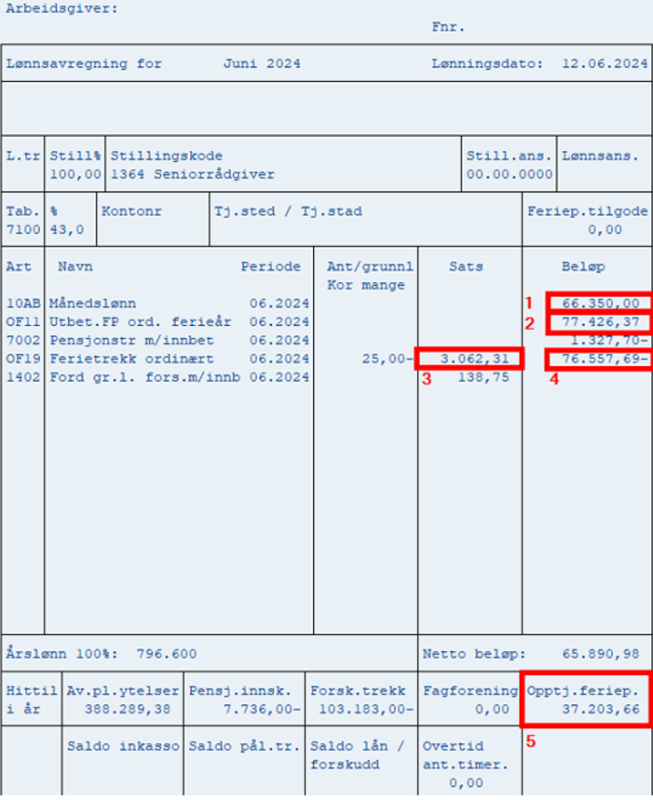

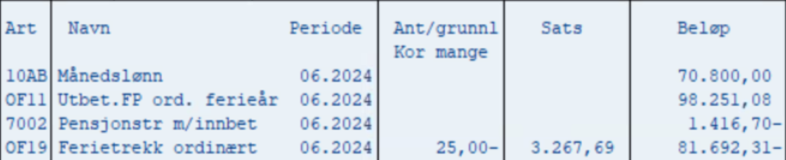

The payslip for June

- Monthly salary for June

- Earned holiday pay from the previous year, 12% of earned income. For those 60 years or older, an additional 2,3% is calculated to pay for the 6th vacation week. These 2,3% are limited to 6G.

- Daily rate, i.e the cost/amount deducted per vacation day. This is calculated based on gross annual salary and part-time percentage as per the 1st of June

- Total deduction for 5 vacation weeks.

- Earned holiday pay for the current year. Payable next year.

Tax deductions in June

- Holiday pay is always taxable income and is included in the basis for calculating of tax for the income year.

- If the holiday pay is paid in the year after the year of accrual (and under certain conditions), no tax is to be deducted. In order for there to be no deduction of tax from holiday pay at the time of payment, the tax card is adjusted so that a little more tax is deducted from the regular salary the other months of the year.

- If the employee has only been employed part of the previous year, the monthly salary cannot be paid without deduction of tax.

- Tax will also always have to be deducted in June the year the employee starts in the agency.

Example of partial earnings:

In this example the following is part of the deduction basis:

1001 Gross salary 18.704,20

7002 Pension deduction -374,50

OF19 Leave deduction, ord. -5179,62

8320 Parat (trade union fee deduction) -224,45

= Deduction basis 12.925,00

The deduction basis is always rounded down to the nearest whole number. The same applies to the tax deduction.

Holiday deductions

On the payment for June, you wil lreceive the monthly salary, as well as the earned holiday pay from last year.

There will also be a deduction for the number of paid vacation days earned last year. This is called holiday deduction ("ferietrekk"), and is made on the payment for June for all state employees.

If you take any paid vacation days in any other month of the year, you will receive your ordinary salary for that month.

In the example above, the first line indicated the monthly salary for June. The second line indicated the amount of holiday pay accrued last year. Finally, the fourth line indicates the holiday deduction, which in this case is 25 days of paid vacation.

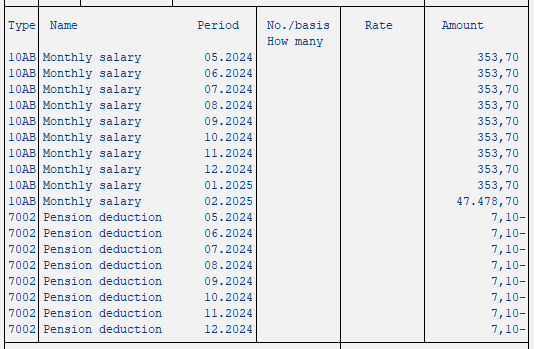

Information about recalculation after registration of new salary

For employees registered with a changed salary after central supplements or local negotiations, a recalculation will be made for the period(s) affected by said change.

On the payslip, it will appear as shown in the image below.

The image shows the payslip of an employee who, before the new annual salary was registered, had an annual salary of NOK 556,900, but who, after the salary settlement, has received a new annual salary of NOK 570,144 from the 1st of May 2024.

The payslip shows month by month what the difference amounts to, and also shows deductions for the difference in pension deductions for the corresponding period.

Recalculation of overtime

A similar recalculation as for monthly salary is also done for overtime paid during the period the salary is recalculated for.

On the payslip, this is indicated by deductions for the hours of overtime that have already been paid based on the monthly salary registered in the recalculation period. In addition, there will be a new posting for the same hours of overtime, but with the updated hourly rate that would have been applicable had the employee's salary been updated at the time of payment.

Kontakt

Do you have questions about the content of this page?

Contact our customer service centre

- lonn [at] dfo.no (lonn[at]dfo[dot]no)

- (+47) 40 63 40 21