You can use the form Extra tax payment when you want a fixed amount as additional tax payment every month.

You can only have one additional tax payment at a time. If you already registered an additional tax payment and want to change the amount, you must send a new form with a new amount. This form will replace the previous one you sent for the same period.

You can only register additional tax payment for a maximum of one year at a time. The earliest possibility for registering additional tax payment for the next year will be after the December salary payment.

How to add additional tax payment

You can find the form for additional tax payment under Salary in the self service portal.

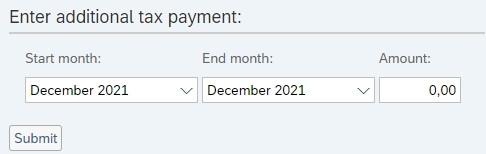

When you open the form, it will be empty unless you have registered additional tax payment previously. If you have already registered additional tax payment, you will see these details.

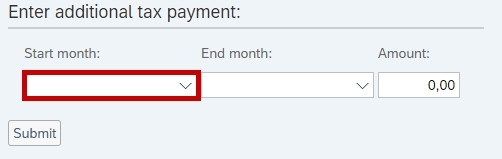

Select the start month of the additional tax payment by clicking the dropdown menu.

The salary calculation will happen approximately one week before salary payment. After this has started for the current month, it will not be possible to add additional tax payment for this month. First applicable month will in this case be the next month.

Select the end month of the additional tax payment by clicking the dropdown menu. Additional tax payment will be deducted also for the end month. Select December as the end month if you want additional tax payment throughout the year.

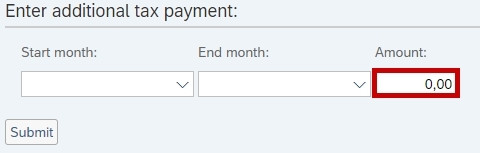

Enter the monthly amount in the field for Amount. Do not use minus sign.

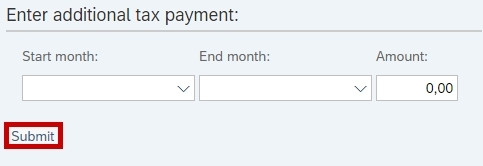

Click Submit when you have entered all the information. This will activate the additional tax payment, and the specified amount will be deducted for each month that you entered.

A unique sequence number will appear in the top left corner once the form has been submitted. You can also find this sequence number under List of all forms in the self service portal.

How to edit additional tax payment

If you want to edit the existing additional tax payment, you must register a new form.

The previously entered information will appear. Edit the information you want to change and click Submit.

You will not be able to see the previously entered information if you want to edit a form that has just been sent for approval. This happens because the first registration is not yet activated. Try again later.

How to delete additional tax payment

You can delete an additional tax payment if the salary calculation has not yet been performed for the months you want to delete.

If you want to retract a registration before the salary calculation (which happens approximately one week before salary payment) you can register a new form with the same start and end month. Enter zero (0,00) as the amount. Click Submit.

You can delete an additional tax payment for future periods if the salary calculation has not yet been performed. If you have registered additional tax payment throughout the year but want to delete it for a specified month, you can enter this month as start and end month and enter amount zero. Click Submit.

Contact

Do you have questions about the content of this page?

Contact our customer service centre

- lonn [at] dfo.no (lonn[at]dfo[dot]no)

- (+47) 40 63 40 21